Why We (Still) Use DFA Funds

Recently, a journalist asked me why Yardley Wealth continues to use the mutual funds available through Dimensional Fund Advisors (DFA). While Vanguard is probably familiar to you as the giant mutual fund family known for its low costs and passive indexing approach, DFA is also a low cost fund family that uses passive investing, and emphasizes small cap and value investing based on what is known as the “Fama and French Three Factor Model.” Only professional financial advisors can access DFA, whereas anyone can access Vanguard’s funds. As a result of the interview, I was quoted in this article,

The Quarter of Reckoning at Dimensional Fund Advisors (RIA Intel, May 20, 2020).

Two weeks prior, I had a question from a client about how his investment portfolio had performed compared recently to the Dow Jones Industrial Average or “The Dow.”

I thought that the answers to these questions would make a useful blog post. So here goes …

At our firm, Yardley Wealth, we take a long-term perspective. We look at long-term expectations for various stock and bond returns and build portfolios around those for our clients.

We don’t care what is doing best right now or in the most recent past. Okay, well, that might not be totally accurate. Let me explain: We do care and stay informed on what is going on in the world, but we don’t change our strategy from the one that has worked best for our purposes for the past 100 years.

The Dow is a price-weighted average of 30 old-ish U.S. companies. People follow it because it was the first widely-known stock index, and it was owned by the newspaper that people looked to for financial information. It’s not really a great measure of how the markets are doing, though. Comparing your own portfolio against it over any period, especially a short one, doesn’t really mean anything. Looking at The Dow (or any stock market index) should never make you feel good or bad because it is not a relevant comparison to a globally diversified portfolio.

The Dow has no small company stocks, no foreign stocks, no emerging market stocks and of course, no bonds. It is also price-weighted, not market cap weighted.

A company with a higher stock price influences the Dow index more than a stock with a lower price. That actually makes no sense because the price doesn’t mean anything at all. A stock can have a higher stock price but ½ as many shares outstanding so be worth ½ as much as another company, but it would influence the movement of The Dow more just because of that higher stock price.

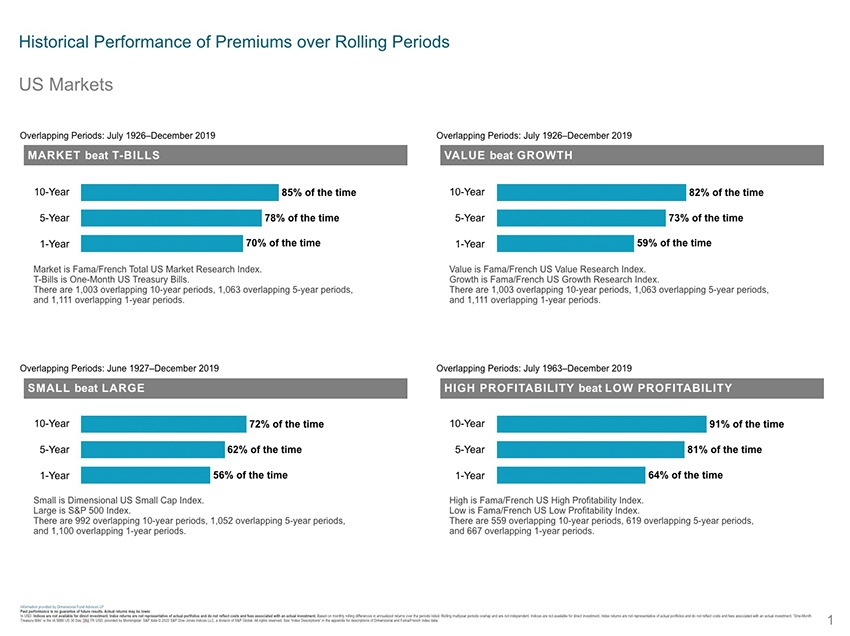

Please take a look at the following slide. It explains a lot of what we do and why our clients are invested the way they are. Here are the relevant takeaways:

- Stocks beat bonds over most, but not all, timeframes. The longer the timeframe, the more likely stocks are to outperform bonds.

- Value beats growth over most, but not all, timeframes. The longer the timeframe, the more likely value is to outperform growth.

- Small company stocks beat large company stocks over most, but not all, timeframes. The longer the timeframe, the more likely small company stocks are to outperform large company stocks.

- Highly profitable companies beat lowly profitable ones over most, but not all, timeframes. The longer the timeframe, the more likely highly profitable companies are to outperform lowly profitable companies.

Looking at these factors and how they influence long-term returns, we build portfolios that take advantage of them. Compared to the market as a whole, our clients are over weighted stocks – specifically: value stocks, small company stocks and the stocks of profitable companies.

Looking at the chart again, it shows that over any 1-year period, our clients are aligned with a portfolio that is likely to do pretty well and, over most 10-year periods, they are highly likely to do so. Over a timeframe as short as a couple of months, I don’t know how they are going to do, and I’m not concerned with that. I’m concerned about long-term growth and that’s why we do things the way we do them here at Yardley Wealth.

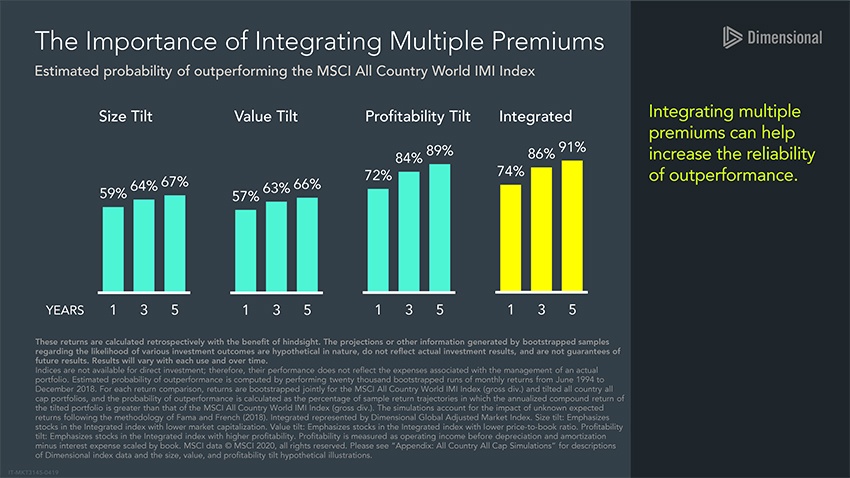

While each of the four factors, noted above, will likely improve your returns over long periods of time, using all of them will often increase the reliability of performance. Remember, the good long-term results of these factors have persisted even though they haven’t been seen too often the last 10 years, so we will keep using them. Please see the next chart, which shows how integrating (a) size, (b) value and (c) profitability can increase the reliability of outperformance in an investment portfolio.

Please contact our office if you have any questions and we’ll be happy to discuss. Meanwhile, let’s all stay healthy and keep our eyes on the horizon. Down markets and health issues, while vexing at any given moment in time, do not last forever. We are strong in our convictions and encourage you to be, too. Hope you get a little extra sunlight in your day — Vitamin D and fresh air is an important element in a healthy, balanced life — especially right now.

My name is Mike Garry, and my company is Yardley Wealth Management, LLC. We are a fiduciary, fee-only financial planning, and wealth management firm in Newtown, Pennsylvania. (That’s in Bucks County).

Our law firm is Yardley Estate Planning, LLC, and is in the same place. We only do Estate Planning work and I am licensed in Pennsylvania and New Jersey.

If you’d like to talk about this or anything else, please reach out: 267-573-1019, [email protected] or @michaeljgarry

If you’d prefer to watch videos, click on the hyperlinks for the: Yardley Wealth Management and Yardley Estate Planning YouTube channels.

If you would like our other written content:

YWM E-Newsletter: https://yardleywealth.net/newsletter-sign-up/

YEP E-Newsletter: http://yardleyestate.net/subscribe/