This month’s blog post comes from a long time friend and colleague of mine, Greg Phelps of Redrock Wealth Management in Las Vegas, Nevada. I hope you enjoy it.

Redefining investment returns correctly

I’ve spent the last 20+ years working with investors of all types. From young savers to distinguished spenders, and everything in between. I’ve witnessed first hand the money mistakes and fallacies most people succumb to.

By miles I’ve found the top three misconceptions the average investor makes. They are:

- Financial planning isn’t a priority. The majority of investors focus on investments and returns. They watch CNBC and think the key to solving their financial problems is maximizing returns. Investments will not solve your financial problems. Investments are simply a tool to execute a great financial plan. Without a solid financial plan your returns – as great as they may be – won’t necessarily solve all of your financial problems.

- Overlooking taxes. With the right tax strategies in place, your investment returns become a smaller part of your financial success. For example, things like Roth conversions, asset location between various types of tax-preferenced accounts, and tax efficient ‘decumulation’ can add guaranteed value to your financial plan. Investing is variable and not guaranteed. Slashing your taxes is critical to squeezing every last drop out of your finances!

- Misunderstanding investment returns. In thousands of clients meetings I’ve found maybe 1-2% of investors truly understand investment returns. Unfortunately, they’re focused on the wrong things! Rather than look at total return, they hunt for yield. Rather than balancing a portfolio, they chase what’s hot. Most importantly, rather than understanding the true return of their investments they forget inflation’s devastating effects.

There are several other things which investors miss as well. Things like risk management using insurance when needed, estate planning and structure, etc. But the three things noted are the most common issues I’ve seen firsthand.

Financial planning (1) is an animal all on it’s own, as is tax mitigation (2). They’re highly customized to each individual situation.

Misunderstanding how inflation works and how your real returns should be calculated (3) is far more commonplace. Since it’s a top three misconception shared by the majority of investors, let’s take a look closer at inflation adjusted returns.

What is inflation anyway?

As the BBC published, inflation is one of the most important factors shaping our economy. Inflation is the increase in prices over time for goods and services in our economy.

For example, a stamp in 1980 was about 15 cents. Today it costs 49 cents to mail a letter. Doing the math, stamp inflation for the last 36 years or so is about 3.5%.

Some goods and services inflate in price faster than others. Medical costs and higher education expenses come to mind first. Others inflate a bit slower, but everything costs more over time.

In the last 100 years or so there have only been two periods of deflation (prices going lower) lasting five years or more. They were during the 1920’s and 1930’s.

It’s a safe bet that inflation is – and always will be – a factor you must contend with during your lifetime. You can search historical inflation rates here. It’s a great table I use to illustrate inflation to clients.

Inflation affects returns

Why is inflation important to you? The cost of everything rises over time. Inflation shows no mercy even if you’re retired. The stamps you buy, the cars you drive, and the trips you take will cost more throughout your lifetime.

So what’s really important? The returns your investments earn or the real value your money actually provides you?

By real value, I’m referring to your ultimate purchasing power. Money is just a tool to purchase things after all.

A million dollar retirement invested in CD’s may not last very long if inflation is 5%, 8%, or in the mid teen’s like the 1970’s. It’s the goods and services you can purchase in current and future dollars that really matters!

Correctly calculating investment returns

It’s a simple concept that most investors simply can’t grasp. Your returns shouldn’t be measured in your investment growth. Your returns should be measured in your purchasing power over time. We call this your “real rate of return”.

It works like this:

So net of inflation you earned 5%. That means your actual purchasing power in real dollars grew by 5%. That’s pretty good right?

So if your investments earn 11% it’s good also right? Not necessarily! If inflation eats up 9-10% of your returns an 11% return may not drive your financial plan if it’s dependent on 3-4% above inflation.

In the mid 1970’s and early 80’s inflation ran rampant. An 11% return was just barely keeping pace with – or even losing at points – your purchasing power.

Lately inflation has been quite tame. Since 2008 inflation has averaged about 1.7%. Goods and services you’re purchasing likely haven’t risen too terribly much in price… certainly not at the historical inflation rate. In fact going back to 1970 inflation has averaged over 4%, so the 1.7% recent inflation rate is quite mild.

How low inflation affects your investment returns

GDP is low (Gross Domestic Product) is low, interest rates at the bank are low, and inflation is low. All of those things lead to compressed investment returns.

You can’t earn as much on fixed income (bonds). The stock market also won’t grow as fast (generally speaking) because interest rates and GDP is low. All investment returns are compressed in low inflation environments like we have today.

The question is what REAL rate of return do you need to make your financial plan effective?

Clients with substantial assets and conservative lifestyles may need simply to keep pace with inflation. They may survive with CD’s in the bank, bond ladders, and other conservative investments.

For the rest of us however, a rate of 2-4% over inflation is generally the goal. This is where your financial plan comes into play. If you don’t have a serious and well constructed plan you’ll never know what rate of real return you need to accomplish your financial goals.

Still not convinced inflation matters?

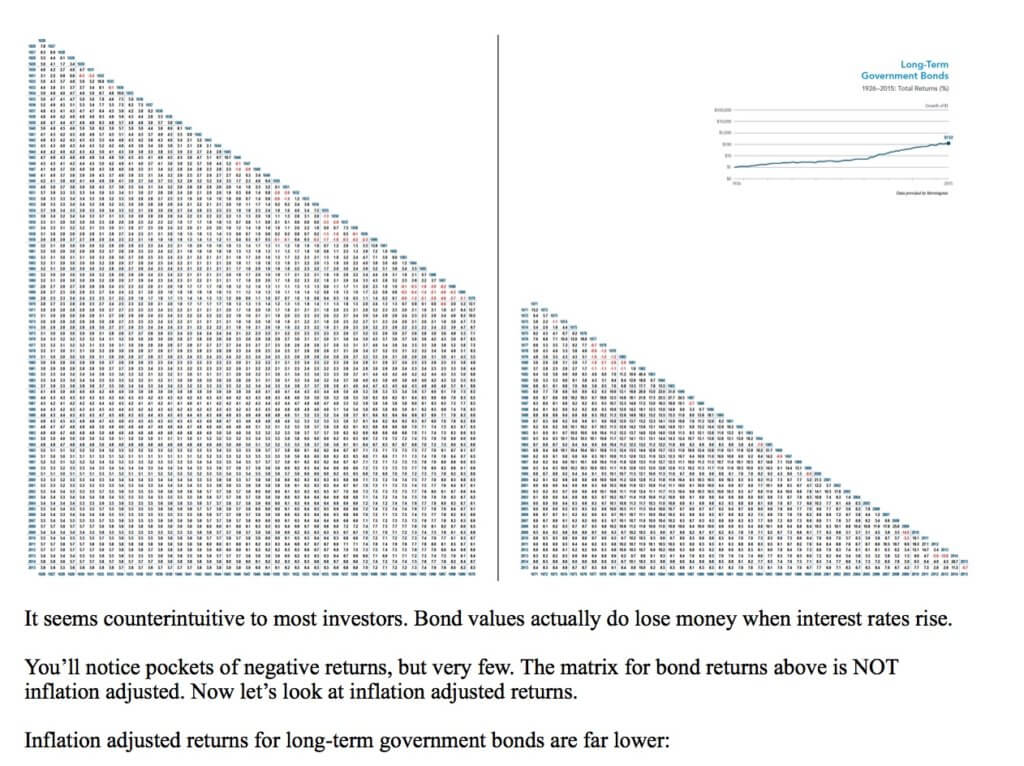

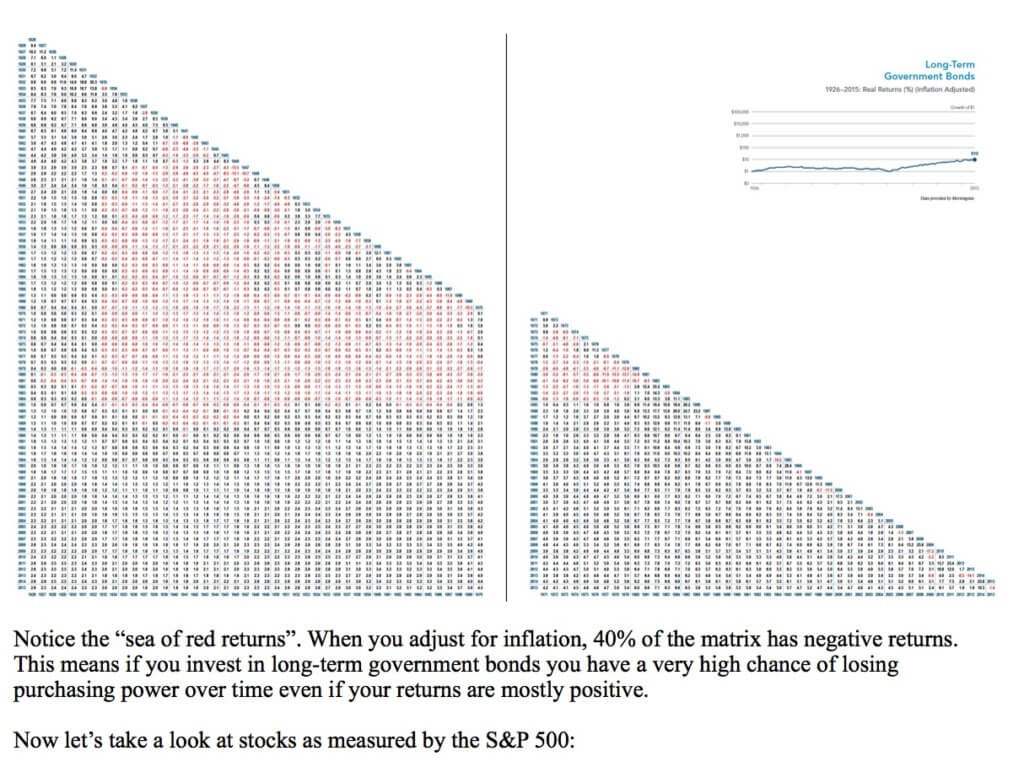

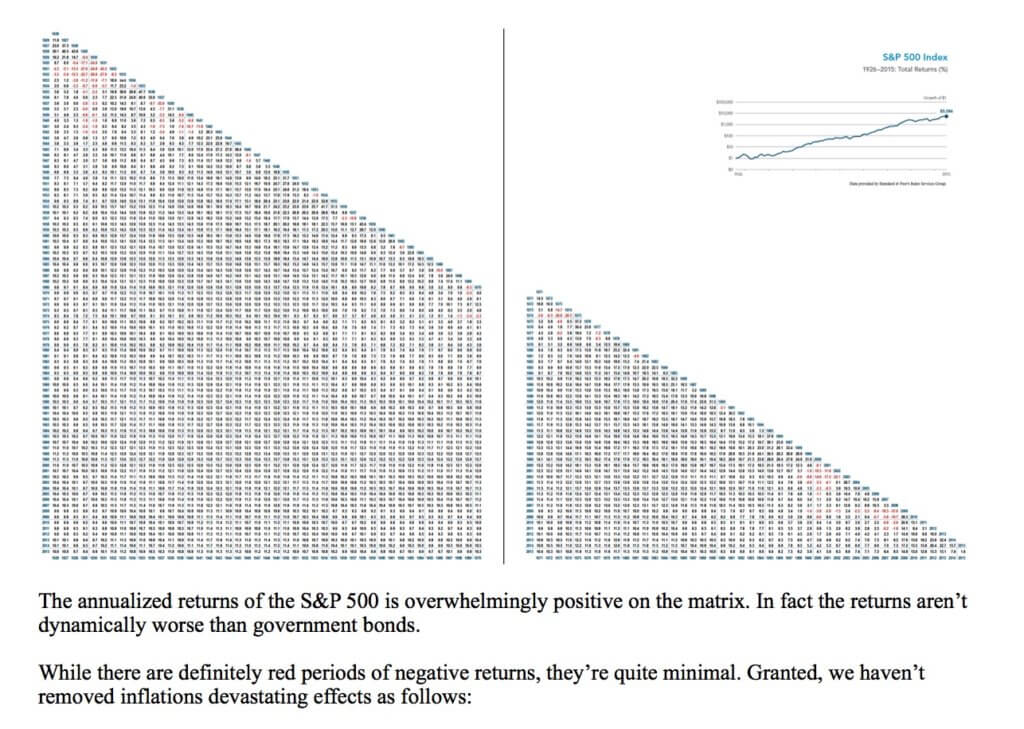

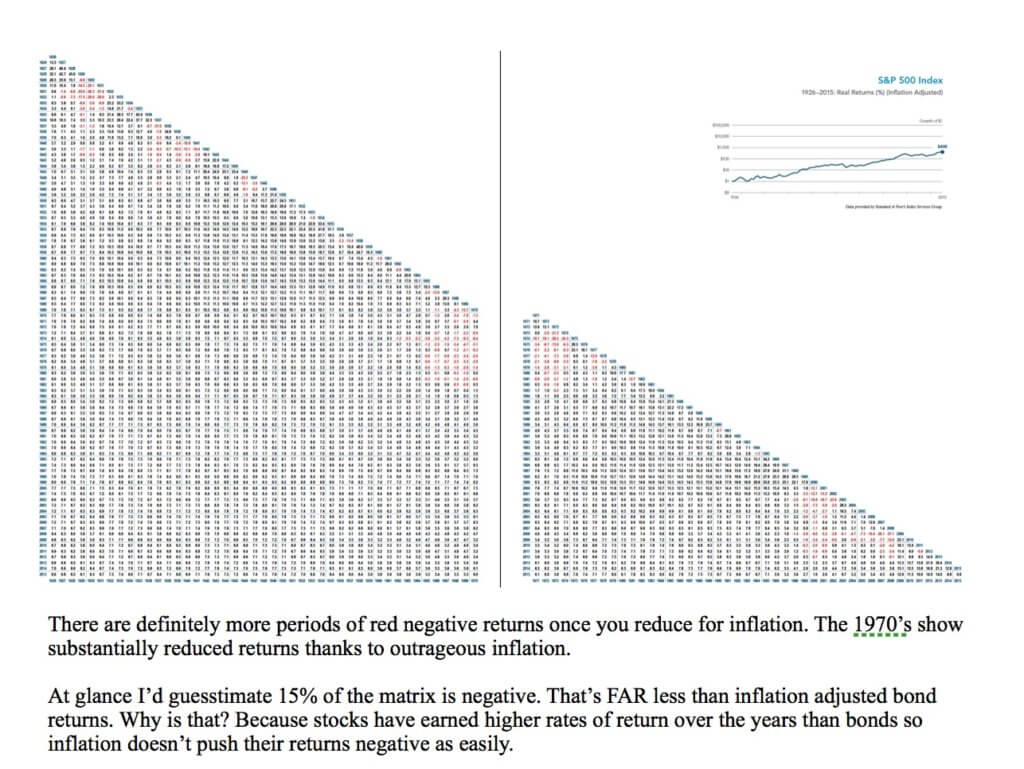

Let’s start by looking at long-term government bond returns over time. This investment return matrix is provided by Dimensional Fund Advisors. They’re the 7th largest mutual fund management company in the country. They’re passive investors, and they create very strong portfolios.

To read this matrix, you find the intersection of one year to another. Start with your earliest year down the left hand column and follow that line horizontally until you reach the year you want to end. That’s the annualized investment return for the time period you selected.

If you want the entire period, just go to the lowest far left return number. Here are long-term government bond returns:

Pay special attention to the red numbers. They are negative returns (when long-term government bonds lost money).

The moral of the story

Inflation adjusted returns are what you should be using to measure your financial plan’s effectiveness. You must understand how the “real rate of return” works. Not every investor or financial advisor does.

Most importantly your financial and investment plan must be the “real deal”. The “real deal” requires 3 things:

- Time. You need time to dedicate to researching financial and investment planning matters. Not only do you need the time to research, you need the time to execute what you’ve learned.

- Desire. You must actually want to do this! Numbers, math, taxes, the law – these aren’t for everyone but they’re all part of a great financial plan.

- Skill. Even if you’d got the time and desire, you also need the skill. Time and desire without skill is a bad combination which will lead to bad results. You need to be educated in all aspects of financial planning and investment management.

Skill is where most people get into trouble. I’m a good example of getting into trouble thinking I had skill. Fortunately it wasn’t in the financial arena that I overestimated my skill.

Years ago I tried to sweat solder copper pipes and install a water softener in my house. It was the ugliest sweat solder job ever! But I really wanted to do it on my own, and even spent hours researching how to do it.

Even though it was ugly, my sweat solder job held up when I turned on the water… for about two years. When my wife came home to a flooded garage one day I vowed never to overestimate my skill again!

The real deal requires time, desire, and skill. You need those three things to effectively manage a financial and investment plan. It’s like a three legged stool, if one leg is weak you’re going to fall on your butt (or flood your garage)!

Financial advisors like my friend Michael Garry are the real deal. They understand you need a financial plan first, and that your investment plan is merely a component of a well drafted financial plan. Not only that, but they minimize your taxes, reduce your risk from investments and life events, and help you protect your family and retirement lifestyle.

If you are one of the majority of investors who didn’t understand how to calculate investment returns properly, I highly recommend taking a step back and hiring the real deal like Michael.

About the author

Greg Phelps, CFP®, CLU®, AIF®, AAMS® is a 20+ year financial industry veteran. His firm Redrock Wealth Management has fee only fiduciary financial advisors in Las Vegas. They specialize in retirement planning and strategize tax minimization strategies for those retired or nearing retirement.