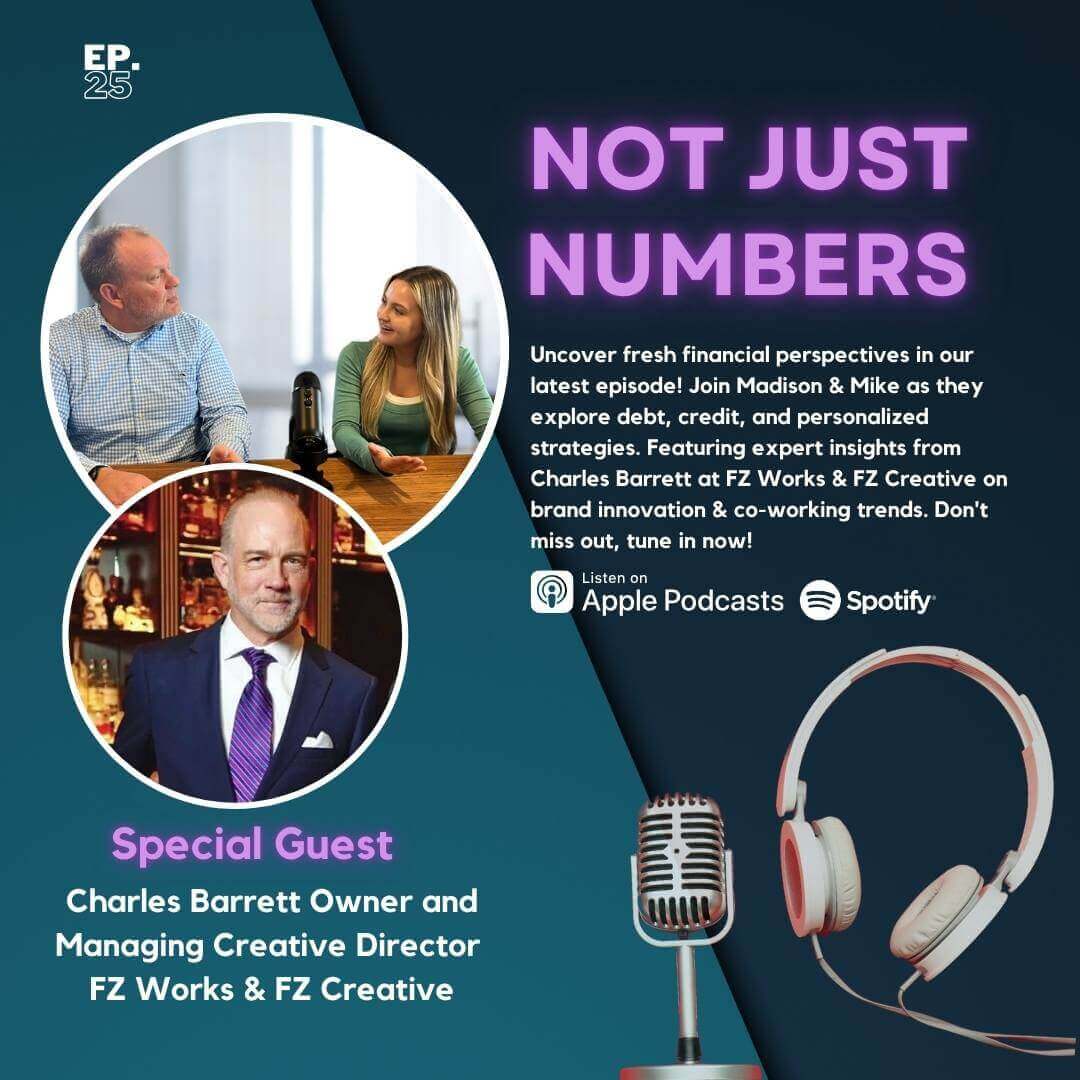

Rethinking Dave Ramsey’s Advice Feat. Charles Barrett from FZ Works & FZ Creative

Introduction:

In this episode of Not Just Numbers, Madison Demora and Mike Garry explore whether Dave Ramsey’s famous financial advice still holds up. With rising living costs and modern economic challenges, younger generations are beginning to question his strict, debt-averse approach. Joined by special guest Charles Barrett from FZ Works & FZ Creative, the hosts dive deep into Ramsey’s principles and how financial advice may need to evolve.

Hosts

Madison Demora, Podcast producer and co-host.

Mike Garry, CFP®: Financial advisor, founder and CEO of Yardley Wealth Management, and estate planning lawyer at Yardley Estate Planning.

Special Guest

Charles Barrett from FZ Works & FZ Creative

Is Dave Ramsey’s Advice Still Relevant?

The episode begins with a discussion of an article from The Wall Street Journal titled “Dave Ramsey Tells Millions What to Do With Their Money. People Under 40 Say He’s Wrong.” Mike reflects on how Ramsey’s approach—focused on avoiding debt, saving aggressively, and living frugally—doesn’t always fit the reality young adults face today.

“We’re seeing housing prices at unaffordable levels and rising interest rates, which makes it harder for young people to follow Ramsey’s advice,” Mike explains.

Ramsey’s methods have helped many, but younger generations, burdened by student loans, high rent, and stagnant wages, are seeking more flexibility in financial advice.

Debt: A Tool or a Trap?

Debt is one of the core issues in Ramsey’s philosophy. He advises people to avoid it at all costs. However, Mike argues that debt isn’t always negative.

“Ramsey suggests buying a cheap car to avoid payments, but a reliable car often requires taking on debt,” Mike says.

He adds that while debt should be managed carefully, it can be a tool to achieve important financial milestones, like buying a house or starting a business.

The Power of Social Media in Financial Conversations

Madison notes that social media has amplified the conversation around personal finance. Platforms like TikTok are full of financial advice—some of it directly challenging Ramsey’s teachings.

“You can hashtag Ramsey and quickly get thousands of people sharing their opinions on his advice,” Mike points out.

Social media has empowered younger generations to seek out more flexible financial guidance that fits their lifestyle.

Dave Ramsey’s Seven Baby Steps: A Solid Foundation, But…

Ramsey’s “Seven Baby Steps” have been the cornerstone of his financial philosophy for decades. Mike agrees that some of the steps, like building an emergency fund, make sense for many people. However, he finds other steps, like paying off your mortgage as fast as possible, to be overly rigid.

“I wouldn’t tell someone to prioritize paying off a mortgage before setting up their retirement. Retirement should come first,” Mike advises.

He stresses that personal finance should be flexible and adjusted to fit individual circumstances.

Guest Spotlight: Charles Barrett on Financial Adaptability

After wrapping up the discussion of Dave Ramsey’s advice, Madison and Mike welcome Charles Barrett from FZ Works & FZ Creative. Charles shares insights on how adaptability is crucial—not just in business, but in personal finance as well.

“Branding, like personal finance, needs to evolve with the times. A rigid approach won’t work in today’s fast-changing world,” Charles says.

Charles highlights how his own business evolved during the pandemic, drawing a parallel to how financial advice must also shift to meet the changing needs of different generations.

The Need for a More Flexible Financial Approach

In closing, Mike emphasizes the importance of financial flexibility. While Ramsey’s advice has helped many, it’s not a one-size-fits-all solution. Younger generations need a more nuanced approach that reflects their unique challenges.

“The Seven Baby Steps are a good foundation, but every person’s situation is different,” Mike concludes.

For more financial insights, visit contact Yardley Wealth Management’s and don’t miss future episodes of Not Just Numbers.